Market Research and Strategy: 10 Tips to Show the Value of Your Research

Creating a research budget can be daunting, especially when it requires buy-in from other teams at your organization. While scoping out your annual market research budget can be time-consuming in and of itself, you may face additional hurdles from those in other departments who need to sign off on your budget. They may be not only in the process of advocating for their own department’s financial needs but also are likely to be less well-versed in the importance of research and development for innovation and the overall value of investing in strategic market research.

To minimize back-and-forth dialogue and potential opposition from those who have the final say over your market research budget, it’s key to proactively show the value of the plan you’re proposing. With this in mind, we’ve compiled helpful tips for how you can best advocate for your market research budget.

Tips for How to Get Your Strategic Market Research Budget Approved

- Provide specific details on what you plan to achieve with your research. Clearly convey your research objectives and how they tie into your organization’s guiding principles and goals. This should offer important context and compelling details into the impact your market research and strategy can have on your overarching organizational goals and KPIs (e.g. specific revenue targets, gaining market share, sustainability & ESG, and cost-savings).

- Educate on the power of making informed decisions instead of going on “gut feelings” or guesses. Whether looking to introduce a new product, test out a new package design, obtain input on a new marketing campaign, expand to a new market, or understand how consumers perceive your competitors, obtaining consumer insights is a valuable tool to inform the ideal next steps. Reminding stakeholders that with big decisions on the line, the ability to leverage data to solve important business questions yields more confidence than merely following a hunch should prove valuable to your research budget discussions.

- Approach your plans from both a micro and a macro lens. While gathering insights from your consumers is important on a project-by-project basis, remain mindful of the valuable impact of longer term, strategic market research. Research methods geared towards uncovering new trends can help you spot white space areas and opportunities to innovate with confidence, which can ultimately result in gaining an advantage in your category and accelerating revenue growth.

- Emphasize that carving a competitive edge requires research. When working to conceptualize new products, there are key advantages of research and development in business. If you think some internal leaders may need some convincing on the benefits of investing in research and development, place an emphasis on how the insights you’ll gain on key areas such as differentiators, consumer pain points, and areas of white space can help you spot opportunities to innovate and gain an advantage over your key competitors and/or become a leader in specific geographic markets.

- Champion new research innovations that help you obtain the deep, in-context insights needed to make decisions with confidence.

- In addition to the benefits of research and development highlighted above, gathering data that enables you to gain a 360-degree view of your consumer at the precise moment a product is being used is more accurate than relying on recall of past actions. This new way to passively collect data removes the barriers of lapses in memory, empowering you to make data-centric decisions and build better products.

- Show how the technology and platforms you’re proposing could be cheaper more reliable than traditional ways of conducting research. Technology in market research has evolved beyond the days of conducting in-person focus groups and IDIs, which tend to be expensive (in terms of costs for both participant recruitment and travel). Additionally, insights gleaned from consumers in an organic setting are often more trustworthy than those collected in a facility away from where participants perform routine activities. In addition to potential inaccuracies stemming from participants being asked to think back on past behavior in a setting that doesn’t mirror their everyday location, conducting research among a group of strangers can also lead to groupthink bias. Thus, when introducing the costs of a new-to-your-company research platform or technology, it will be helpful to indicate that the market research and strategy you’re proposing will result in more cost-effective and accurate insights.

- Illustrate cross-functional collaboration and how the impact extends beyond your department. Is your marketing team looking to test out a new advertising angle? Does your business development team want to understand whether to make an acquisition or expand into a new market? Conveying how your market research and strategy benefits other key stakeholders and teams within your organization (e.g. sales, marketing, product, revenue) is another valuable way to articulate how and why your proposed spend will prove advantageous for all of those across your organization, not just your team.

- Showcase the ROI from previous research spends. Did the findings from a project lead to an increase in revenue that far exceeded what you spent? Were you able to spot pain points in an early iteration of a product and improve them ahead of it hitting the market? If you’re looking for the perfect time to emphasize the specific ways your strategic market research benefited your company, look no further than budget season.

- Plan proactively for the whole year, not just the first few months. While unexpected research needs are bound to come up, once a budget is solidified, it becomes harder to secure additional funds. Consulting the full fiscal calendar of your spending from recent years should help you to map out a plan for a full year of market research, rather than only focusing on the projects you know are likely to be greenlit in the early months of your fiscal year.

- Consider whether research packages & subscriptions could be cheaper than booking one-off projects. Do you have a preferred research vendor or platform that you’re using for several projects a year? Inquiring into whether they offer a package deal or have competitive subscription pricing could ultimately result in a discount.

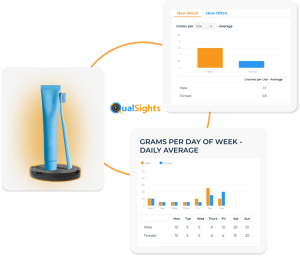

When thinking about your strategic market research budget, consider how verified data adds an important layer of reliability to your results, as relying solely on recall-based surveys can lead to gaps in memory and inaccurate insights. QualSights’ proprietary Smart Sensor Technology and ability to easily combine qualitative and quantitative methodologies enables you to passively and precisely measure product consumption, as well as experiment to see if a new package design or format, messaging cue, or formulation maintains or even accelerates consumption.

If you’re in the process of working through your research budget and planning for the next fiscal year, we’d love to tell you more about our first-of-its-kind technology. Our team can walk you through our proprietary tools to help you forge a deep in-context understanding of your consumers and make decisions informed by data you can trust in.

Research Industry Insights

Research Industry Insights